Are you feeling a bit like Albert?

If one of the smartest minds in history found taxes difficult, is it any wonder that the rest of us are confused? You’re not alone!

The U.S. Tax Code grows larger and more complicated every year, with ever-changing laws, confusing forms, and endless “what ifs”. The good news? You don’t have to figure it out by yourself.

Working with a trusted tax professional means you don’t have to guess, stress, or hope (although prayer is always a good option).

I’m Deb Evans, and I’d love to be your Tax Pro. I will help you make sense of the confusion, answer your questions clearly, and guide you through the process with care and expertise—every step of the way.

As a federally licensed Enrolled Agent (since 2011), I’m trained specifically to understand the tax code and how it relates to you. I explain it in plain English, help you find those valuable deductions, and prepare and file your tax returns accurately, so you can stop worrying about taxes and get back to living your life.

Tax law doesn’t stand still, and neither do I. I complete a minimum of 30 hours of continuing education every year to stay current on new laws and changes, and I’m a member of the American Society for Tax Problem Solvers.

When you work with me, you’re working directly with me. I don’t hand your return off to junior staff or outsource your questions. From start to finish, I handle your taxes personally, with care and attention to detail. I specialize in working with self-employed individuals, small business owners, and real estate investors, although I’m happy to work with anyone who is a good fit.

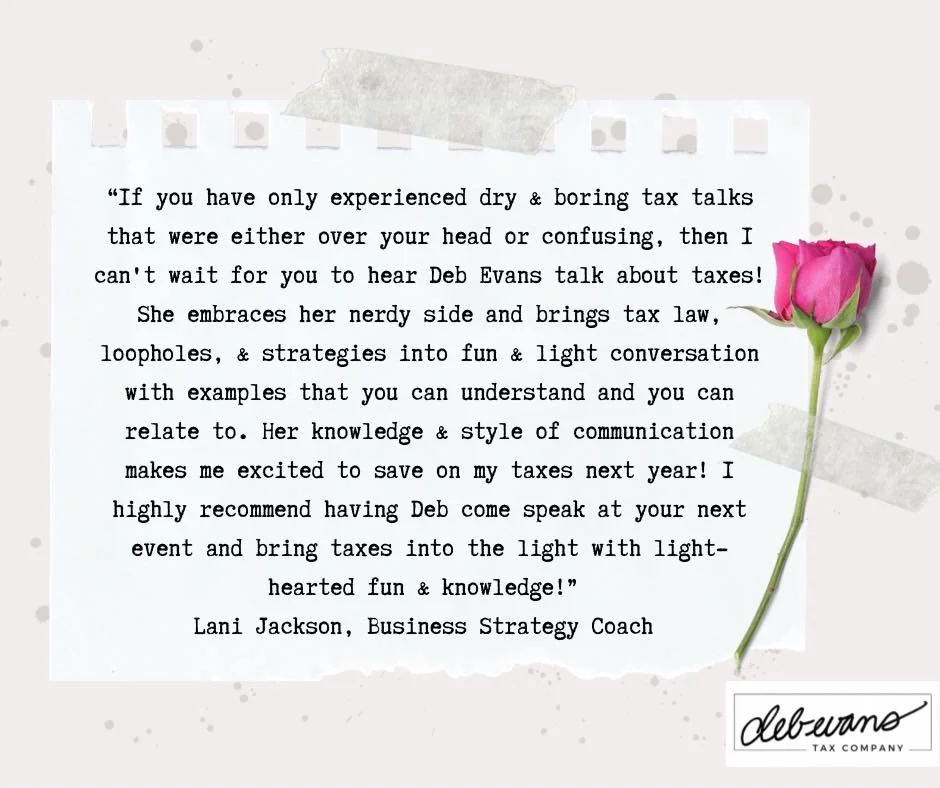

I’m also an author and speaker, and I enjoy helping people better understand their finances. If you’re interested in affordable coaching, workshops, or speaking opportunities, I’d love to connect.

Oh, good. NEW Tax Laws are Here.

(sarcastic font)

Deb’s books are available as paperbacks and e-books on Amazon.

One of the things I’m good at is making the complex much easier to understand. Bottom Line? I’m not a button-down, corporate type. I’m a “Let’s sit on the couch, drink coffee and talk” type.

Deb Evans

Financial and Business Coaching– I am a teacher at heart, and I love to sit down with individuals and new business owners or self-employed pros to go over the fundamentals of what you need to know to be successful. As a Certified Financial Coach and Certified Brain Health Coach, I specialize in money mindset issues that may be preventing you from gaining the success you deserve, as well as strategy and tactics based coaching. My Deep Dive Coaching Sessions are a popular way for my clients to get in-depth yet easy to understand answers to their questions. Packages are customized to your needs.

Tax Planning – How will the new tax laws affect your taxes? Are there any changes you can/should make? A tax planning summary is included with your tax return, but let’s be honest – by the time you prepare your tax return, it’s too late to change anything for that year, and for many clients, we are nearly halfway through the next year! True tax planning should be separate from tax preparation. It only works when it happens beforehand, not after! Be proactive, not reactive! Schedule an affordable tax planning consultation at least once a year and get ahead of the curve! You can bundle planning with prep.

Tax Preparation – My focus is on tax return preparation for individuals and families, including those with small businesses (LLCs and Sole Proprietorships), investment income (real estate investors), and others with more complicated tax issues. You can bundle prep with planning.

Author - I am a multi-published writer, including business and finance books for solopreneurs. My books are available as paperbacks and ebooks on Amazon. Ebooks and digital planners are available on this website!

Speaking Engagements - I am available to present affordable tax workshops to your business, professional, or networking groups. Reach out for details.

What I don’t do - I do not offer bookkeeping or payroll services. I am not currently accepting S-Corp, C-Corp, or Partnership clients for tax preparation and compliance work. (I’m happy to offer coaching and tax planning to you, however.)

SERVICES

If you’re looking for a friendly ally who takes her work seriously but herself not-so-much…. If you are looking for a more personal touch from a pro who doesn’t treat you like you’re “just” a client, then we should chat.

Be sure to check the blog on this site AND follow my Facebook page – @evanstaxco – I keep it updated with tax and financial news that you need to know in an easy to understand way.